Can I have 2 ROTH IRAs?

Is it better to have one IRA or multiple?

Contents

- 1 Is it better to have one IRA or multiple?

- 2 Can you have 2 Roth IRAs accounts?

- 3 Can I open a Roth IRA with 100000?

- 4 How much can I put in a Roth IRA 2021?

- 5 How much does Dave Ramsey say to put into retirement?

It may be wise to own more than one IRA if each IRA has a different characteristic or benefit. Since Roth IRAs offer the possibility of tax-exempt distributions, it may be a good idea to add money to a Roth account, if you qualify for it, while you are in a lower tax bracket and think you are in a higher tax bracket when you retire.

What if I have 2 IRA accounts? There is no limit to the number of traditional individual retirement accounts, or IRAs, that you can set up. However, if you set up multiple IRAs, you cannot contribute more than the contribution limits on all of your accounts in any given year.

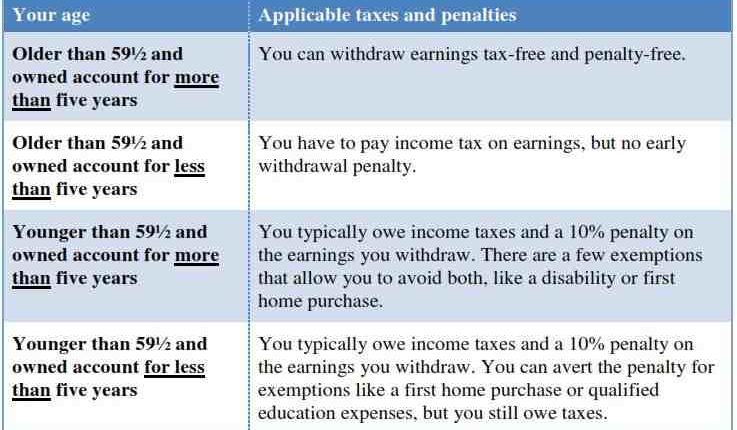

What is the 5 year rule for Roth IRA?

The Roth IRA five-year rule states that you cannot withdraw income tax-free until it has been at least five years since you first contributed to a Roth IRA account. This rule applies to everyone who contributes to a Roth IRA, whether they are 59½ years old or 105 years old.

Can you buy and sell in a Roth IRA without penalty?

You can trade mutual funds within your Roth IRA (or traditional IRA) without tax consequences. If you plan to sell a mutual fund in a Roth IRA and withdraw the money, you will not owe any tax as long as you meet the criteria for a qualifying distribution.

When can you take money out of a Roth IRA without penalty?

You can withdraw your contributions to a Roth IRA without penalty at any time for any reason, but you will be penalized for withdrawing any investment income before age 59.5, unless it is for an admissible reason.

Can you lose money in an IRA?

Understanding IRAs An IRA is a type of tax-efficient investment account that can help individuals plan and save for their retirement. IRAs allow a wide range of investments, but – as with any volatile investment – individuals can lose money in an IRA if their investments are marked by the ups and downs of the market.

Can an IRA decrease in value?

Investments can sometimes lose value. These losses can present challenges when your investments are in an Individual Retirement Account (IRA). … Previously, you could get tax relief if your IRA lost money in the markets. This tax provision has been pending since 2018.

Is an IRA a good investment?

It’s important to note that IRAs can also be ideal for the 67% of people who have access to a workplace-based plan. If you’re maximizing your contributions to it, or just want another option with more control over your investment, an IRA can be a great way to save even more money for retirement.

What is the best IRA to get?

Best individual retirement accounts

- Best overall: Charles Schwab IRA.

- Ideal for first-time investors: Fidelity Investments IRA.

- Ideal for experienced investors: Vanguard IRA.

- Ideal for investors without intervention: Betterment IRA.

- Ideal for field investors: E * TRADE IRA.

What type of IRA is best?

In general, if you think you are in a higher tax bracket when you retire, a Roth IRA may be the best choice. You’ll pay taxes now, at a lower rate, and withdraw funds tax-free in retirement when you’re in a higher tax bracket.

Can you have 2 Roth IRAs accounts?

How many Roth IRAs? There is no limit on the number of IRAs you can have. You can even have multiple IRAs of the same type, which means you can have multiple Roth IRAs, SEP IRAs, and Traditional IRAs. … You are free to distribute this money among the types of IRAs in any given year, if you wish.

Is It Bad To Have Two Roth IRAs? Having multiple Roth IRA accounts is perfectly legal, but the total contribution you put into both accounts still cannot exceed the annual contribution limits set by the federal government.

Can a couple have two Roth IRAs?

IRAs can only be opened and owned by individuals, so a married couple cannot jointly own an IRA. However, each spouse can have a separate IRA or even multiple Traditional and Roth IRAs.

An IRA cannot be jointly owned by spouses. It can only be detained on behalf of one person.

Should a married couple have two ROTH IRAs?

As long as they meet specific federal requirements to be allowed to contribute to a Roth, each spouse in a marriage can contribute money to a Roth IRA on their own behalf. Couples cannot both contribute to a single IRA listed with their two names, but must instead maintain their own Roth IRA accounts.

Is there a limit on Roth IRAs?

More Retirement Plans For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your Traditional IRAs and Roth IRAs cannot exceed: $ 6,000 ($ 7,000 if you’re 50 or older ), Where . If less, your taxable earnings for the year.

Why are Roth IRAs limited?

Contributions to a Traditional IRA, Roth IRA, 401 (k), and other retirement savings plans are limited by the Internal Revenue Service (IRS) to prevent well-paid workers from benefiting more than the average worker from benefits. tax benefits they offer.

Do Roth IRAs have limits?

Roth IRA contribution limits, 2021-2022 income limits. The Roth IRA contribution limit is $ 6,000 in 2021 and 2022 ($ 7,000 for those 50 or older).

Can I open a Roth IRA with 100000?

You can open a Roth IRA if you earn more than $ 100,000 per year as long as your income does not exceed certain limits set by the IRS and you have chosen the correct tax reporting status.

How Much Money Can You Open a Roth IRA With? Roth IRA Income Limits MAGI is calculated by taking the Adjusted Gross Income (AGI) from your tax return and adding deductions for things like student loan interest, self-employment taxes, and higher education expenses. Most people qualify for the maximum contribution of $ 6,000, or $ 7,000 for those 50 and over.

Can I open a Roth IRA with $10000?

Maximize an IRA That $ 10,000 is more than enough to maximize an IRA for the year. The IRA contribution limit is $ 6,000 in 2021 and 2022 ($ 7,000 if 50 or older). … If you are not concerned about this tax deduction, you can choose a Roth IRA.

How much is too much to open a Roth IRA?

If your adjusted gross income exceeds $ 131,000 (for single filers) or $ 193,000 (for couples), you cannot contribute directly to a Roth IRA. To work around this problem, you fund a traditional IRA and then convert the money to a Roth.

What is the minimum balance to open a Roth IRA?

Opening a Roth IRA – The Basics Generally speaking, no minimum balance is required to start funding a Roth IRA. Whether you are willing to deposit $ 100 or $ 1,000, you can do so without incurring any penalties or fees.

What is the best way to invest $100 000?

Here are some of the best ways to invest $ 100,000:

- Focus on growing sectors and stocks. The global economy is changing at a rapid pace, with some industries expanding and others contracting. …

- Buy dividend-paying stocks. …

- Invest in ETFs. …

- Buy bonds and bond ETFs. …

- Invest in REITs.

How much monthly income will 100k generate?

A $ 100,000 annuity would earn you $ 521 per month for the rest of your life if you purchased the annuity at age 65 and started receiving your monthly payments within 30 days.

How much interest does 100k earn?

How much interest will I earn on $ 100,000? The amount of interest you will earn on $ 100,000 depends on your rate of return. Using a conservative estimate of 4% per annum, you would earn $ 4,000 in interest (100,000 x 04 = 4,000).

How much can I put in a Roth IRA 2021?

More information on pension plans Note: For contribution limits for other pension plans, see Pension topics – Contribution limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all your Traditional IRAs and Roth IRAs cannot exceed: $ 6,000 ($ 7,000 if you’re 50 or over), or.

Can I put 50,000 in a Roth IRA? Roth IRA Alternatives You can contribute up to $ 19,500 per year in 2021 and $ 20,500 in 2022 (with an additional $ 6,500 as a catch-up contribution for those 50 or older). Some employers even offer a Roth version of 401 (k) with no income limit.

How much can I contribute to my 401k and Roth IRA in 2021?

For 2021 and 2022, you can contribute up to $ 6,000 to a Roth or traditional IRA. If you are 50 or over, the limit is $ 7,000. The maximum you can contribute to a 401 (k) in 2021 is $ 19,500, or $ 26,000 if you’re 50 or older.

Can you contribute to both Roth 401k and Roth IRA?

It is possible to have both a Roth IRA and a Roth 401 (k) at the same time. However, keep in mind that a Roth 401 (k) must be offered by your employer in order to participate. During this time, anyone with earned income (or any spouse whose partner has earned income) can open an IRA, within the stated income limits.

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $ 19,500 in 2020 to a 401 (k) plan. If you are 50 or older, the maximum annual membership fee increases to $ 26,000. You can also contribute up to $ 6,000 to a Roth IRA in 2020. This climbs to $ 7,000 if you are 50 or older.

Can I contribute $5000 to both a Roth and traditional IRA?

Yes, a person can contribute to both a Roth IRA and a Traditional IRA in the same year. The total contribution in both cannot exceed $ 5,500 for people under 50 and $ 6,500 for people 50 and over. … Income limits for Roth IRA contributions. The current tax rate.

Can you contribute 6000 to both Roth and traditional IRA?

IRA Contribution Limits This contribution limit applies to all of your combined IRAs, so if you have both a Traditional IRA and a Roth IRA, your total contributions for all accounts combined cannot exceed $ 6,000 (or 7 $ 000 for 50 years and over).

How much can I put into traditional and Roth IRA?

The maximum you can contribute to all of your Traditional and Roth IRAs is the lesser of the following amounts: for 2020, $ 6,000 or $ 7,000 if you are 50 or over at the end of the year; Where. your taxable earnings for the year.

How much does Dave Ramsey say to put into retirement?

To properly fund your retirement, we recommend that you invest 15% of your gross income. This means that if you earn $ 50,000 a year, you should invest $ 7,500 in your retirement savings.

How Much Do I Need at Dave Ramsey Retirement? Maybe you want a retirement income of $ 100,000 a year. This means you’ll need over a million mutual funds with an annual return of around 12% *. And as Dave explains, 4% of that amount covers increases in the cost of living. If you want an annual income of $ 50,000, your nest egg should be around $ 625,000.

Should I invest more than 15% in retirement?

Fidelity rule of thumb: Aim to save at least 15% of your pre-tax income each year for retirement, which includes all correspondence with the employer.

How much of my retirement should I invest?

In fact, most financial experts suggest investing 15% of your income annually in a retirement account (including any employer contribution). With 401 (k) s, or employer sponsored retirement plans, you might find that your company offers a match if you contribute a certain amount.

Is 20 percent enough for retirement?

Saving Needs If you’re starting to save for retirement in your twenties, the general rule of thumb is that you can get away with saving only 10-12% of your take-home pay. If you’re starting out in your 40s, the rule of thumb is to increase your savings rate by 15-20%.

How much should I contribute to my retirement per paycheck?

Most financial planning studies suggest that the ideal percentage of contribution to saving for retirement is between 15 and 20% of gross income. These contributions could be made into a 401 (k) plan, 401 (k) correspondence received from an employer, IRA, Roth IRA and / or taxable accounts.

How much should I contribute to my 401k every paycheck to max out?

“Once you get past the age of 50, you can contribute $ 27,000 to your employer’s 401 (k) plan. This can certainly help make up for the savings gaps in the overall life planning strategy. retirement of a worker. ” An older worker would need to save $ 2,250 per month, or $ 1,125 per bi-monthly paycheck, to maximize a 401 (k) plan.

How much should you put in retirement from every paycheck?

You should consider saving 10-15% of your income for retirement.

Comments are closed.