What is a good retirement salary?

How much do I need in my 401k to retire at 60?

Contents

The goal is for you to live a good retirement life and not have to worry about money. The above average 60 year old should have at least $ 800,000 in his 401k if they have been diligently saved and invested. However, the average 60-year-old has close to $ 170,000 in his 401k.

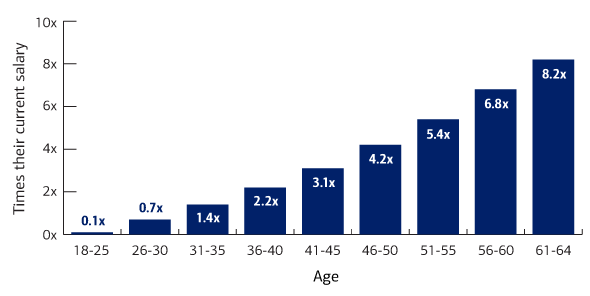

How much money do you need to retire comfortably at age 60? According to guidelines made by the investment company Fidelity, you should at the age of 60 have saved about eight times your annual salary if you plan to retire at age 67, the age at which people born after 1960 can receive full social security benefits.

Is 500k enough to retire on at 60?

The short answer is yes – $ 500,000 is sufficient for some retirees. The question is how it will work, and what conditions make it work well for you. With a source of income such as social security, relatively low expenses and a little luck, this is feasible.

How much should I have in 401k to retire?

The guidelines usually range from 60% to 80%. If you have a household income of $ 100,000 when you retire and you use the 80% income reference as a goal, you need $ 80,000 a year to maintain your lifestyle.

Can I retire with 500k in my 401K?

Generally, experts recommend withdrawing 4% or less of your pension funds each year to ensure that your money lasts. Assuming you have $ 500,000 in retirement, you can realistically withdraw $ 20,000 your first year of retirement.

How much does a person need in a 401K to retire at 55?

Experts say they have saved at least seven times their salary at age 55. This means that if you earn $ 55,000 a year, you should have at least $ 385,000 saved for retirement. Remember that life is unpredictable – financial factors, medical treatment, how long you live will also affect your pension expenses.

What is the average 401k balance for a 60 year old?

| AGE | YEARS OF WORK | NO GROWTH |

|---|---|---|

| 45 | 23 | $ 437,000.00 |

| 50 | 28 | $ 534,500.00 |

| 55 | 33 | $ 632,000.00 |

| 60 | 38 | $ 729,500.00 |

How much does the average 39 year old have saved for retirement?

Only about 55% of people between the ages of 35 and 44 have a retirement account, and the median balance is $ 60,000.

How much should a 39-year-old have saved for retirement? Retirement Savings Target If you earn $ 50,000 within 30 years, you should have $ 50,000 knocked for retirement. At the age of 40, you should have three times your annual salary. At the age of 50, six times your salary; at age 60, eight times; and at age 67, 10 times.

How much should a 39 year old have in 401k?

Fidelity says at the age of 40, aim to have a multiple of three times your salary saved up. This means that if you earn $ 75,000, your retirement balance should be around $ 225,000 when you turn 40. If your employer offers both a traditional and a Roth 401 (k), you may want to split your savings between the two.

How much 401k should I have at 39?

To help you know if you’re on the right track, pension plan provider Fidelity set standards for how much you should have saved at any age. By the time you are 40, Fidelity recommends deducting three times your salary. If you earn $ 50,000 a year, you should aim to have $ 150,000 in retirement savings when you are 40.

How much does average 40 year old have in 401k?

From the second quarter of 2018, Americans between the ages of 40 and 49 had an average 401 (k) balance of $ 103,500 and contributed 8.4 percent of paychecks. Fidelity also found that employers matched an average of 4.6 percent, setting the total savings rate for forty-somethings at 13 percent.

What net worth is considered wealthy?

Most Americans say that in order to be considered “rich” in the United States by 2021, you must have a net worth of almost $ 2 million – $ 1.9 million to be exact. That’s less than the net worth of $ 2.6 million Americans set as the threshold for being considered prosperous by 2020, according to Schwab’s 2021 Modern Wealth Survey.

What is the average net worth of the upper class?

What is the net worth of the top 5 %?

Net value US percentiles – Top 1%, 5%, 10% and 50% in net value

- The top 1% of net worth in the US in 2021 = $ 10,500,000.

- The top 2% of net worth in the US in 2021 = $ 2,400,000.

- The top 5% of net worth in the US in 2021 = $ 1,000,000.

- Top 10% of net worth in the US in 2021 = $ 830,000.

What percentage of Americans have a net worth of over $1000000?

A new study has found that there are 13.61 million households with a net worth of $ 1 million or more, not including the value of their primary residence. That is more than 10% of households in the United States. So the United States is definitely the country with the most millionaires.

What is the net worth of the top 10%?

As of the first quarter of 2021, the 10 percent had 69.8 percent of the total U.S. net worth (which is the value of all assets a person has minus all debt). The top 1 percent had about half of that wealth – 32.1 percent, while the next 9 percent had about another half of 37.7 percent.

How much does the average retired person live on per month?

According to data from the Bureau of Labor Statistics, “older households” – defined as those run by someone 65 and older – spend an average of $ 45,756 a year, or about $ 3,800 a month.

Comments are closed.