How much will my 401k grow in 20 years?

The rule says that to find the number of years needed to double your money at a given interest rate, you just divide the interest rate by 72. For example, if you want to know how much you will need to double your money to eight percent. interest, divide 8 by 72 and get 9 years.

Will my 401k grow if I stop contributing?

Contents

- 1 Will my 401k grow if I stop contributing?

- 2 What is a good rate of return on 401k 2021?

- 3 How much money do you need to retire with $100000 a year income?

Your 401K will continue to grow even if you don’t stop contributing, as long as you leave it in your current retirement account, or transfer it to a new one, either with a new employer or through an external account. If you withdraw your funds, they may not grow, and you may delay your withdrawal.

How much will my 401k grow if I stop contributing? How much could your 401 (k) grow if you stopped contributing? … Expect your annual pre-tax rate of return on your 401 (k) to be 5%. Your boss match is 100% up to a maximum of 4%. (However, because it stops contributing, the employer’s starting amount is now $ 0 per year).

What happens if you don’t contribute to 401k?

You will have to pay income tax on the entire amount. If you are not even 59 ½, you will still have to pay the 10% penalty.

Is it worth contributing to a 401k if there is no match?

Between the tax deductibility of your contributions, the deferral of your investment income tax, and your ability to accumulate an incredible amount of money for your retirement, a 401 (k) plan is worth participating in, even without the company’s departure.

Does 401k grow without contributions?

You will not pay taxes on contributed funds until you withdraw the funds, typically in withdrawal. 1 Your savings grow faster because they are tax-deferred. Your 401 (k) will enjoy a steady growth without touching the tax until you retire and start withdrawing money.

Is it mandatory to contribute to 401k?

No, there is no minimum that you will contribute to your traditional 401 (k) plan. To maximize the potential of your retirement account, on the other hand, there are suggested amounts that need to be contributed. There is also a maximum that you are allowed to contribute to your account. This maximum is based on certain criteria.

What is a good rate of return on 401k 2021?

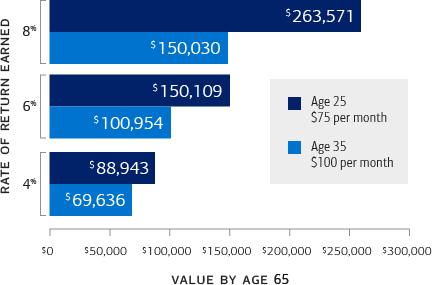

Many retirement plans suggest that the typical 401 (k) portfolio generates an average annual return of 5% to 8% based on market conditions.

What is the average return of a 401k?

What is a good rate of return on 401 K per year?

The average 401 (k) rate of return varies from 5% to 8% per annum for a portfolio that is 60% invested in stocks and 40% invested in bonds. Of course, this is only an average that financial planners suggest using to estimate returns.

What is the average return on 401k in 2020?

The average return of 401 (k) in 2020 was 15.1%, according to Vanguard data. In the last three years, the average return has been 9.7%, and 11% in the last five years. To grow your account, get the most out of it, make sure your account is invested, and save more.

What is a good 401k rate?

Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions may be made in a 401 (k), 401 (k) match plan received from an employer, IRA, Roth IRA and / or taxable account.

What is a good monthly rate of return on 401k?

Risk and Return Balance Now, it is time to return to that range from 5% to 8% that we mentioned above. It is an average rate of return, based on the moderately aggressive common allocation among investors participating in the 401 (k) plans which consists of 60% shares and 40% debt / cash.

How are 401ks doing in 2021?

The average 401 (k) balance grew to a high of $ 129,300 in the second quarter of 2021, up 24 percent from the same period a year ago. The average balance of the 403 (b) account grew to a record $ 113,300, even 24 percent. The average IRA balance was $ 134,900, a 21 percent jump over the same period in 2020.

What is the 401K catch up for 2021?

Any age 50 years or older is eligible for an additional catch-up contribution of $ 6,500 in 2021 and 2022.

How do I protect my 401K in 2021?

How to protect your 401 (k) from a bag crash

- Protect Your 401 (k) From A Bag Crash.

- Diversification and Asset Allocation.

- Rebalancing Your Portfolio.

- Try to have money on hand.

- Keep contributing to your 401 (k) and other retirement accounts.

- Don’t panic and withdraw your money first.

- Bottom Line.

What is a good percentage for 401k?

Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions may be made in a 401 (k), 401 (k) match plan received from an employer, IRA, Roth IRA and / or taxable account.

What does 6% 401k match mean?

It means that a patron corresponds to the first 6% of the 401k contributions of each payment. So if your gross pay is $ 1000: If you contribute 6% ($ 60), then your employer also contributes $ 60.

Is 4% a good 401k match?

Most employers require workers to save between 4 and 6 percent of their pay to get the maximum match possible.

What percentage should I contribute to my 401k at age 30?

Fidelity recommends that Americans save 15% of their salary over the course of their career to retire with 10 times their salary in retirement savings. This is how Fidelity recommends that Americans be saved at any age: Around 30, you should have the equivalent of your salary saved.

How much money do you need to retire with $100000 a year income?

Most experts say that your retirement income should be about 80% of your final pre-retirement income. 1 This means that if you earn $ 100,000 a year in retirement, you need at least $ 80,000 a year to have a comfortable lifestyle after leaving the workforce.

How much money do you need to retire with $ 75,000 a year income? This is sometimes called a “replacement winter”. So if you earn $ 75,000 a year now, you need at least $ 60,000 a year to maintain your way of life. Multiply that amount by your life expectancy after retirement. Once you know your goal, it’s time to calculate the amount to put in each month.

Can you retire comfortably on 100k a year?

1ï »¿If you and your partner earn together $ 100,000, for example, the two of you would plan to save enough money to have between $ 75,000 and $ 85,000 a year in retirement.

Is 100k a year good for retirement?

Some experts recommend saving at least 70 – 80% of your pre-retirement income. This means that if you earn $ 100,000 a year before retiring, you should plan to spend $ 70,000 – $ 80,000 a year on retirement. One benefit of this strategy is that it is easy to calculate.

How much super do I need to retire on $100 000 a year?

If you’re hoping to retire at the age of 50 with an annual income of $ 100,000, you’ll need a whopping $ 1,747,180 in super!

What is a good monthly retirement income?

The median pension income for seniors is about $ 24,000; however, the average income can be much higher. On average, seniors earn between $ 2000 and $ 6000 per month. Older retirees tend to earn less than younger retirees. It is advisable to save enough to replace 70% of your monthly pre-retirement income.

What is a good retirement income per month?

According to 2016 data from the Bureau of Labor Statistics, the average 65-plus family spends $ 48,885 per year, which travels to about $ 4,000 per month.

Can I retire on $5000 a month?

Generally, you can generate at least $ 5,000 a month in retirement income, guaranteed for the rest of your life. This does not include Social Security Benefits.

How much do I need to retire on $80 000 a year?

Using the default assumptions built into the Moneysmart Retirement Calculator – and assuming you’re single, you will retire at the age of 65, want the funds to last until the age of 90, and demand an annual income of $ 80,000 (indexed annually to inflation) – “So you need about $ 1,550,000 from retirement to live in a …

How much money do you need to retire with $80000 a year income?

Based on expenses For example, if you and your partner decide to supplement your Social Security income with an additional $ 40,000 from your savings each year, you will need a portfolio value of $ 1 million when you retire. If you and your partner want to retire $ 80,000 a year, you need $ 2 million.

How much super do I need to retire on $100 000 a year?

If you’re hoping to retire at the age of 50 with an annual income of $ 100,000, you’ll need a whopping $ 1,747,180 in super!

Comments are closed.