How much money does the average 70 year old have in savings?

Average net worth is the average net worth; the net values of a group are averaged by one. Median net worth is the value that is right in the middle of all those numbers.

What is the average Social Security check?

Contents

- 1 What is the average Social Security check?

- 2 What is upper middle class net worth?

- 3 What is the average net worth of a 70 year old male?

- 4 What is the average net worth of a 75 year old couple?

- 5 At what age do most people retire?

- 6 How much should you have in savings by 70?

Social Security offers a monthly benefit check to many types of beneficiaries. As of August 2021, the average check is $ 1,437.55, according to the Social Security Administration, but that amount can differ dramatically depending on the type of recipient.

How much will I get from Social Security if I earn 60,000 a year? Workers who earn $ 60,000 per year pay payroll taxes on all their income because the wage base limit on Social Security taxes is almost twice that amount. Therefore, you will pay 6.2% of your salary, or $ 3,720.

What is the average Social Security check at age 65?

At age 65: $ 2,993. At age 66: $ 3,240. At age 70: $ 4,194.

What is the maximum Social Security benefit at age 65 in 2020?

The maximum Social Security benefit in 2020 is $ 3,790 per month if you retire at age 70. The maximum Social Security benefit per month is $ 3,011 for retirement at age 66; $ 2,857 for retirement at age 65; and $ 2,265 for retirement at age 62.

What is the average SS payment per month?

The average Social Security retirement benefit is $ 1,563.82 per month, according to the Social Security Administration (SSA). The maximum is $ 3,240 per month for those who start collecting at full retirement age (FRA) and had high income for 35 years.

What is the average Social Security check at age 67?

| Get older | Average profit |

|---|---|

| Sixty-five | $ 1,321 |

| 66 | $ 1,489 |

| 67 | $ 1,504 |

| 68 | $ 1,522 |

What is the average Social Security benefit at age 62?

According to payment statistics from the Social Security Administration in June 2020, the average Social Security benefit at age 62 is $ 1,130.16 per month, or $ 13,561.92 per year.

What is the maximum Social Security benefit at age 62?

In 2021, the maximum amount you can get in benefits if you claim at age 62 is $ 2,324, but if you qualify for the maximum and your full retirement age is 66, then waiting until then to start your benefits entitles you to $ 3,113 per month. That’s a big increase for waiting five years or less to apply for Social Security.

How much will I get a month if I retire at 62?

If a person of full retirement age received $ 1,000 in benefits per month, a person who retired at 62 would only receive $ 708 per month by comparison. While those who wait until age 70 would receive $ 1,253 per month.

What is upper middle class net worth?

The upper middle class, also known as the mass wealthy, is loosely defined as individuals with a net worth or investable assets between $ 500,000 and $ 2 million. The upper middle class is also sometimes known as the aspirational class or HENRY.

What level of salary is the upper class? According to a 2018 report from the Pew Research Center, 19% of American adults live in “higher income households.” The median income for that group was $ 187,872 in 2016. Pew defines the upper class as adults whose annual household income is more than double the national median.

What is the net worth of the top 5 %?

US Net Worth Percentiles: Top 1%, 5%, 10%, and 50% in Net Worth

- Top 1% of Net Worth in US in 2021 = $ 10,500,000.

- Top 2% of Net Worth in US in 2021 = $ 2,400,000.

- Top 5% of Net Worth in US in 2021 = $ 1,000,000.

- Top 10% of Net Worth in US in 2021 = $ 830,000.

What percentage of Americans have a net worth of over $1000000?

About 8 million or 6 percent of American households have high net worth with investable assets of $ 1 million or more. Another 6.4 million households, considered wealthy, have investable assets between $ 500,000 and $ 999.9,000.

What net worth put you in the top 5%?

5% in 2020, a household needed a net worth of $ 17,557,208. The top.

What is the net worth to be considered wealthy?

How High Should Your Net Worth Be To Be Rich? Schwab conducted a Modern Wealth survey in 2021 and found that Americans believe it takes an average personal net worth of $ 1.9 million to be considered wealthy.

What income is considered wealthy in 2020?

With an income of $ 500,000, he is considered rich, wherever he lives! According to the IRS, any household that makes more than $ 470,000 a year in 2021 is considered a source of income greater than 1%.

What does your net worth have to be to be wealthy?

Most Americans say that to be considered “rich” in the US in 2021, you must have a net worth of almost $ 2 million, $ 1.9 million to be exact. That’s less than the $ 2.6 million net worth Americans cited as the threshold for being considered wealthy in 2020, according to Schwab’s 2021 Modern Wealth Survey.

What is the average net worth of a 70 year old male?

According to Fed data, the median net worth of Americans between the ages of 60 and 70 is $ 266,400. The median (or median) net worth for this age group is $ 1,217,700, but since averages tend to slope higher due to high-net-worth households, the median is a much more representative amount.

How much does an average 75 year old have in retirement savings? Both generations lag far behind baby boomers (ages 57-75), who average $ 102,400 in personal savings and $ 138,900 in their retirement accounts.

What is a good net worth at 70?

One formula suggests that your net worth at age 70 should be 20 times your annual spending. Marotta recommends following a savings plan that will result in a net worth 20 times higher than your annual expense at age 72. 3 With this plan, the older you get, the more you save.

What is a high net worth by age?

Median age net worth for Americans is $ 76,340 for those under 35, $ 437,770 for those 35-44, $ 833,790 for those 45-54, $ 1,176,520 for those 55-64, $ 1,215,920 for those 65 to 74 and $ 958,450 for those 75 and older.

What is the average savings of a 70 year old?

How much does the average 70-year-old save? Based on data from the Federal Reserve, the average amount of retirement savings for people ages 65 to 74 is just over $ 426,000. While it’s an interesting fact, your specific retirement savings may be different than someone else’s.

What net worth is rich by age?

| Age of head of household | Average net worth | Average net worth |

|---|---|---|

| 35-44 | $ 91,300 | $ 436,200 |

| 45-54 | $ 168,600 | $ 833,200 |

| 55-64 | $ 212,500 | $ 1,175,900 |

| 65-74 | $ 266,400 | $ 1,217,700 |

What is the net worth of top 5%?

US Net Worth Percentiles: Top 1%, 5%, 10%, and 50% in Net Worth

- Top 1% of Net Worth in US in 2021 = $ 10,500,000.

- Top 2% of Net Worth in US in 2021 = $ 2,400,000.

- Top 5% of Net Worth in US in 2021 = $ 1,000,000.

- Top 10% of Net Worth in US in 2021 = $ 830,000.

What is the net worth to be considered wealthy in 2020?

Most Americans say that to be considered “rich” in the US in 2021, you must have a net worth of almost $ 2 million, $ 1.9 million to be exact. That’s less than the $ 2.6 million net worth Americans cited as the threshold for being considered wealthy in 2020, according to Schwab’s 2021 Modern Wealth Survey.

How much does the average 70 year old have in savings?

How much does the average 70-year-old save? Based on data from the Federal Reserve, the average amount of retirement savings for people ages 65 to 74 is just over $ 426,000. While it’s an interesting fact, your specific retirement savings may be different than someone else’s.

How much should a 70 year old have in savings?

By age 70, you should have at least 20 times your annual expenses in savings or as reflected in your overall net worth. The higher the expense coverage ratio at 70, the better. In other words, if you spend $ 75,000 a year, you should have about $ 1,500,000 in savings or equity to live a comfortable retirement.

What is the average net worth of a 75 year old couple?

| Age of head of household | Average net worth | Average net worth |

|---|---|---|

| 45-54 | $ 168,600 | $ 833,200 |

| 55-64 | $ 212,500 | $ 1,175,900 |

| 65-74 | $ 266,400 | $ 1,217,700 |

| 75 | $ 254,800 | $ 977,600 |

What should be the net worth of a married couple? Depending on the source, the median net worth in the United States is between $ 150,000 and $ 250,000. But the median net worth in the United States is closer to $ 90,000.

How much money does the average retired couple have?

According to the SSA, the average benefit for a couple when they both receive benefits will be $ 2,753 in 2022. This is an increase of $ 2,559 in 2021. It means that the typical older couple will have an annual income from SSA of $ 33,036 in 2022.

What is the average savings of a retired couple?

According to Fidelity, the following is what the average American has saved for retirement: 20-29: $ 15,000. 30 to 39: $ 50,800. 40 to 49: $ 120,800.

How much does the average 65 year old have in retirement savings?

Based on data from the Federal Reserve, the average amount of retirement savings for people ages 65 to 74 is just over $ 426,000.

How much does the average 70 year old have in savings?

How much does the average 70-year-old save? Based on data from the Federal Reserve, the average amount of retirement savings for people ages 65 to 74 is just over $ 426,000. While it’s an interesting fact, your specific retirement savings may be different than someone else’s.

How much should a 70 year old have in savings?

By age 70, you should have at least 20 times your annual expenses in savings or as reflected in your overall net worth. The higher the expense coverage ratio at 70, the better. In other words, if you spend $ 75,000 a year, you should have about $ 1,500,000 in savings or equity to live a comfortable retirement.

At what age do most people retire?

When asked when they plan to retire, most people say between 65 and 67 years old. But according to a Gallup poll, the median age people retire is 61.

How much does the average person have when they retire? According to this survey from the Center for Transamerican Retirement Studies, the median retirement savings by age in the US is: 20-year-old Americans: $ 16,000. Americans in their 30s: $ 45,000. 40-year-old Americans: $ 63,000.

What is the average retirement age in 2020?

The median retirement age in the United States is 62 for retirees, while the expected retirement age for current workers is 64. The full retirement age is 67 for those born after 1959. The retirement age is lower in Alaska and West Virginia, where people retire. at 61 on average.

How much should you have in savings by 70?

By age 70, you should have at least 20 times your annual expenses in savings or as reflected in your overall net worth. The higher the expense coverage ratio at 70, the better. In other words, if you spend $ 75,000 a year, you should have about $ 1,500,000 in savings or equity to live a comfortable retirement.

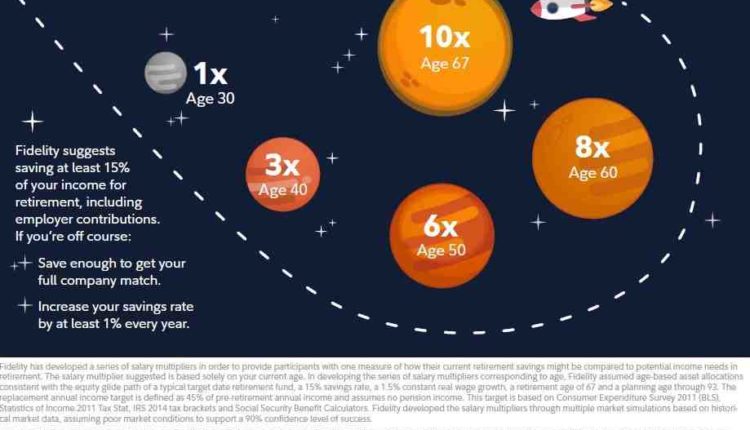

How much should you have saved for retirement by age? At age 30: the equivalent of your saved annual salary; If you earn $ 55,000 per year, before your 30th birthday you should have saved $ 55,000. At age 40: three times your income. At age 50: six times your income. At age 60: eight times your income.

How much should a retired person have in savings?

The investment management company Fidelity recommends that you set aside at least 15% of your annual pre-tax income for retirement.6 If you can’t save 15% of your salary, save as much as you can and make sure you save enough. to get the maximum benefit from your company’s matching contribution, if one is offered.

How much cash should a retired person have?

Bradbury suggests that retirees keep 12 to 24 months of living expenses in cash. However, the amount may depend on monthly costs and other sources of income.

How much does the average 70 year old have in savings?

How much does the average 70-year-old save? According to data from the Federal Reserve, the average amount of retirement savings for people between the ages of 65 and 74 is just above $ 426,000. While it’s an interesting fact, your specific retirement savings may be different than someone else’s.

Comments are closed.