How many 401k millionaires are there?

What percentage of the population has a 401k?

Contents

- 1 What percentage of the population has a 401k?

- 2 How much should a 30 year old have in 401k?

- 3 How much money does the average 40 year old have in the bank?

- 4 How much does a person need in a 401k to retire at 55?

- 5 What percentage of Americans have a net worth of over $1000000?

While a 401k is one of the best retirement savings options available to many, only 32% of Americans invest in one, according to the U.S. Census Bureau. That’s surprising given the number of employees who have access to one: 59% of working Americans.

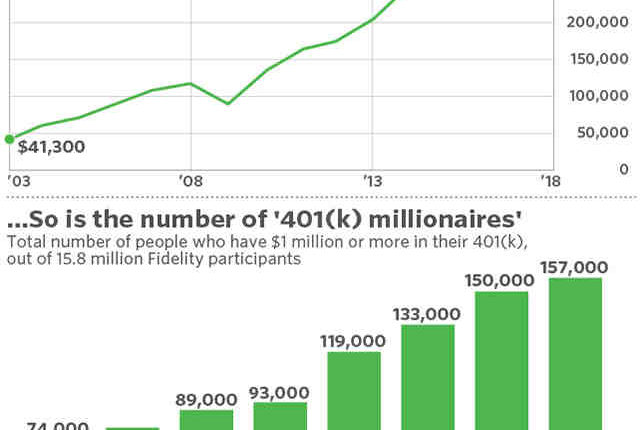

How many people have $1000000 in their 401k? The number of 401(k) accounts with a balance of at least $1 million at Fidelity Investments grew 84% year-on-year to 412,000, while the number of seven-figure IRAs jumped more than 64% to 341,600 in the 12 months ended the second quarter, Fidelity said.

How much does the average American have in their 401k?

How did your 401(k) balance build up? In 2020, the average 401(k) balance for Vanguard participants was $129,157, according to Vanguard’s 2021 How America Saves report. The median balance, however, was much lower, coming in at $33,472.

How much should a 40 year old have in 401k?

If you make $50,000 by age 30, you should have $50,000 to retire. By age 40, you should have three times your annual salary. At 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8 If you reach age 67 and earn $75,000 per year, you should have $750,000 in savings.

How much does the average person have in their 401k?

| AGE | AVERAGE BALANCE 401K | MEDIAN BALANCE 401K |

|---|---|---|

| 25-34 | $26,839 | $10,402 |

| 35-44 | $72,578 | $26.188 |

| 45-54 | $135,777 | $46,363 |

| 55-64 | $197,322 | $69,097 |

How much should a 30 year old have in 401k?

If you make $50,000 by age 30, you should have $50,000 to retire. By age 40, you should have three times your annual salary. At 50, six times your salary; at the age of 60, eight times; and at the age of 67, 10 times. 8 If you reach age 67 and earn $75,000 per year, you should have $750,000 in savings.

How much should a 30 year old save? By age 30, you should have saved nearly $47,000, assuming you’re earning a relatively average salary. This target amount is based on a rule of thumb that you should aim to have about a year of saved salary by the time you enter your fourth decade.

How much should I have in my 401k at 30?

At age 30, Fidelity recommends having the equivalent of one year’s salary saved in your workplace retirement plan. So, if you make $50,000, your 401(k) balance should be $50,000 by the time you reach 30.

How much should a 30 year old have saved for retirement?

By age 30, you should have saved an amount equal to your annual salary for retirement, as recommended by Fidelity and Ally Bank. If your salary is $75,000, you should set aside $75,000. How did you do that? “When starting your career, commit to automatic savings of 20% per year into your 401(k).

How much should I have in my 401K at 35?

So, to answer that question, we believe having one to one and a half times your income saved for retirement by age 35 is a reasonable goal. This is an achievable goal for someone who starts saving at the age of 25. For example, a 35-year-old who earns $60,000 will be on the right track if he saves about $60,000 to $90,000.

How much should you have in your 401k by age?

A good rule of thumb is to add one year of saved salary for every five years old – for example, at 30 you want to save one year of salary, at 35, two, at 40, three, and so on.

How much does a person need in a 401k to retire at 55?

Experts say to save at least seven times your salary by age 55. That means if you’re making $55,000 a year, you should have at least $385,000 saved for retirement. Remember that life is unpredictable–economic factors, medical care, how long you live will also affect your retirement costs.

How much money should I have in my 401k at age 60?

If you’re asking yourself, “How much should I have in my 401(k) at 60?†you are not alone. A general rule of thumb is to have six to eight times your salary saved at the time, although more conservative estimates may skew higher.

How much should I have in my 401k at 35?

So, to answer that question, we believe having one to one and a half times your income saved for retirement by age 35 is a reasonable goal. This is an achievable goal for someone who starts saving at the age of 25. For example, a 35-year-old who earns $60,000 will be on the right track if he saves about $60,000 to $90,000.

How much should you have in 401k by 36?

Given that the median age in America is around 36, the average 36 year old should have a 401k balance of around $120,000. Unfortunately, $120,000 is still pretty low. Below is the average 401k savings by age range in 4Q2020 according to Fidelity.

How much should I have in my 401k at 40?

If your household income is close to $50,000, you should still see a nice 30% increase in your retirement savings if you consistently keep 20% of your after-tax income. At 40, you should literally have over $500,000 or more in your 401k.

How much money does the average 40 year old have in the bank?

| Income percentage | 2016 average savings | 2019 average savings |

|---|---|---|

| 20–39.9 | $1,800 | $2,100 |

| 40–59.9 | $4,000 | $4,400 |

| 60–79.9 | $8,700 | $10,000 |

| 80–89.9 | $19,900 | $20,000 |

How much does the average 40 year old save? According to this survey by the Transamerica Center for Retirement Studies, the median retirement savings by age in the US are: Americans in their 20s: $16,000. Americans in their 30s: $45,000. Americans in their 40s: $63,000.

How much money should I have in the bank at 40?

At 40, you should be saving a little over $175,000 if you were earning a median salary and following the general rule that you should have saved about three times your salary by then. … A good savings goal depends not only on your salary, but also on your expenses and how much debt you owe.

How much should a 40 year old have in savings?

At 40: Save three times your annual salary. If you earn $50,000, you should plan to have $150,000 saved for retirement at age 40.

How much does the average person have saved in the bank?

American households had an average bank account balance of $41,600 in 2019, according to data from the Federal Reserve. The median bank account balance is $5,300 according to the same data.

How much has the average person get in savings?

How much does the average person have in savings in the UK? The average person has £11,000 in savings–half of people have more saved, and half of people have less. Savings includes checking and savings accounts, ISAs, stocks, stocks, bonds, trusts and other financial assets.

How much does the average 30 year old have in their bank account?

How much money does the average 30 year old save? If you do have $47,000 saved at age 30, congratulations! You are way ahead of your peers. According to the 2019 Federal Reserve Consumer Finance Survey, the median retirement account balance for people under 35 is $13,000.

How much does a person need in a 401k to retire at 55?

Experts say to save at least seven times your salary by age 55. That means if you’re making $55,000 a year, you should have at least $385,000 saved for retirement. Remember that life is unpredictable – economics, medical care, how long you live will also affect your retirement costs.

How much money do you need in your 401K to retire at 55? For example, generally accepted retirement planning advice suggests that you save seven times your annual income by age 55. So, if you make $100,000 a year, you need $700,000 saved on your 55th birthday.

What percentage of Americans have a net worth of over $1000000?

About 8 million or 6 percent of US households have a high net worth with investable assets of $1 million or more. Another 6.4 million households, considered affluent, have between $500k and $999.9k in investable assets.

Is a net worth of 1 million considered rich? Schwab conducted a Modern Wealth survey in 2021 and found that Americans believe you need an average personal net worth of $1.9 million to be considered rich. … Some people may consider themselves rich if they have a net worth of $1 million while others will not say they are rich until they have $5 million.

What percentage of the US population has a net worth of 1 million dollars?

A new survey found that there are 13.61 million households with a net worth of $1 million or more, excluding the value of their primary residence. That’s more than 10% of households in the US. So the US is definitely the country with the most millionaires.

What is the net worth of the top 5 %?

US Net Worth Percentiles – Top 1%, 5%, 10%, and 50% in Net Worth

- Top 1% of net worth in the US in 2021 = $10,500,000.

- Top 2% of net worth in the US in 2021 = $2.4 million.

- Top 5% of net worth in the US in 2021 = $1,000,000.

- Top 10% of net worth in the US in 2021 = $830,000.

What percentage of the population has a net worth of $2 million dollars?

We estimate there are 8,046,080 US households with a net worth of $2 million or more. That’s roughly 6.25% of all US Households.

What percentage of the US population has a net worth over 5 million?

Somewhere around 4,473,836 households have a net worth of $4 million or more, while about 3,592,054 have at least $5 million. Respectively, that is 3.48% and 2.79% of all American households.

What is the net worth of the top 5 %?

US Net Worth Percentiles – Top 1%, 5%, 10%, and 50% in Net Worth

- Top 1% of net worth in the US in 2021 = $10,500,000.

- Top 2% of net worth in the US in 2021 = $2.4 million.

- Top 5% of net worth in the US in 2021 = $1,000,000.

- Top 10% of net worth in the US in 2021 = $830,000.

Is a net worth of 5 million considered rich?

Very high-net-worth individuals have a net worth of at least $5 million, whereas very-high-net-worth individuals have at least $30 million in net worth.

What is the net worth of the top 5 %?

US Net Worth Percentiles – Top 1%, 5%, 10%, and 50% in Net Worth

- Top 1% of net worth in the US in 2021 = $10,500,000.

- Top 2% of net worth in the US in 2021 = $2.4 million.

- Top 5% of net worth in the US in 2021 = $1,000,000.

- Top 10% of net worth in the US in 2021 = $830,000.

What is the net worth of the top 10 percent in the US?

In Q1 2021, the top 10 percent held 69.8 percent of the total US net worth (which is the value of all the assets a person owns minus all his liabilities). The top 1 percent hold about half of that wealth – 32.1 percent, while the next 9 percent hold about the other half at 37.7 percent.

What net worth put you in the top 5%?

5% in 2020, a household needs a net worth of $17,557,208. On .

Comments are closed.