What do ROTH IRAs invest?

As with single filers, married couples may have multiple IRAs – even if common retirement accounts are not allowed. You can either contribute to your own IRA, or one account can contribute to both accounts.

What are the downsides of a Roth IRA?

Contents

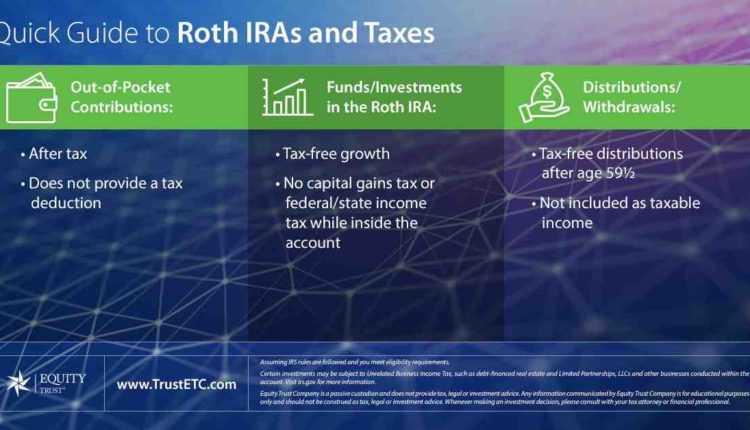

A key disadvantage: Roth IRA contributions are made with cash after tax, which means there are no tax deductions in the year of the contribution. Another drawback is that withdrawals from account earnings must not be made before at least five years have elapsed since the first contribution.

Can You Lose Money in a Roth IRA? Yes, you can lose money in a Roth IRA. The most common causes of a loss include: negative market fluctuations, early withdrawal penalties, and an insufficient amount of time to complete. The good news is that the longer it takes for a Roth IRA to grow, the less likely it is to lose money.

When would you not want a Roth IRA?

Roth IRA contributions from single filers are prohibited if your income is $ 140,000 or more in 2021. The gradual entry range for singles is $ 125,000 to $ 140,000. Single taxpayers cannot contribute to a Roth in 2022 if they earn $ 144,000 or more. Your contribution is reduced if you make between $ 129,000 and $ 144,000.

Are ROTH IRAs high risk?

But they should follow Thiel’s guidance in one respect: Roth accounts are a great place for high-risk, high-return investments. (Thiel did not comment on the report.) Unlike a traditional individual retirement account or 401 (k), Roths are funded with money after tax.

Why bother with a Roth IRA?

Contributing to a Roth IRA is more fiscally efficient than just investing in a taxable brokerage account. Tax-free Roth IRA money and all contributions and earnings can be withdrawn tax-free once you have kept your Roth IRA open for more than five years.

Why a Roth IRA is a bad idea?

The Roth IRA may seem ideal, but it has disadvantages, including a lack of an immediate tax exemption and a low maximum contribution.

Why you should not convert to a Roth IRA?

If you are approaching retirement or need your IRA money to live on, it is not wise to convert to a Roth. Because you pay taxes on your funds, converting them to a Roth costs money. It takes a certain number of years before the money you pay in advance is justified by the tax savings.

Are ROTH IRAs still a good idea?

A Roth IRA or 401 (k) makes the most sense if you are confident of having a higher income in retirement than you do now. If you expect your income (and tax rate) to be lower in the current withdrawal, a traditional IRA or 401 (k) is probably the best bet.

How much should I put in my Roth IRA monthly?

The IRS, as of 2021, limits the maximum amount you can contribute to a traditional IRA or Roth IRA (or combination of the two) to $ 6,000. Put another way, this is $ 500 a month that you can contribute all year round. If you’re 50 or older, the IRS allows you to contribute up to $ 7,000 a year (about $ 584 a month).

What percentage of my payment should go to the Roth IRA? Most financial planning studies suggest that the ideal contribution percentage to save for retirement is between 15% and 20% of gross income. These contributions may be made in a 401 (k), 401 (k) match plan received from an employer, IRA, Roth IRA and / or taxable account.

Is it good to have 401k and Roth IRA?

The advantages of having a 401 (k) and Roth IRA. … Investment growth for both the 401 (k) s and Roth IRAs is deferred from tax until retirement. This is a good thing for most participants, since people tend to go into a lower tax bracket once they retire, which can lead to substantial physical savings.

Does it make sense to have a 401k and Roth 401k? If you expect to be in a lower tax bracket in retirement, a traditional 401 (k) may make more sense than a Roth account. But if you’re in a lower tax band now and believe you’ll be in a higher tax band when you retire, a Roth 401 (k) might be a better option.

Is it bad to have a 401k and Roth IRA?

The quick answer is yes, you can have a 401 (k) and an individual retirement account (IRA) at the same time. … These plans share similarities in that they offer deferred tax savings opportunities (and, in the case of the Roth 401 (k) or Roth IRA, tax-free earnings as well).

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $ 19,500 by 2020 to a 401 (k) plan. If you are 50 or older, the maximum annual contribution jumps to $ 26,000. You can also contribute $ 6,000 to a Roth IRA in 2020. That jumps to $ 7,000 if you are 50 or older.

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $ 19,500 by 2020 to a 401 (k) plan. If you are 50 or older, the maximum annual contribution jumps to $ 26,000. You can also contribute $ 6,000 to a Roth IRA in 2020. That jumps to $ 7,000 if you are 50 or older.

Can you max out both a Roth 401k and Roth IRA?

You can have a Roth IRA and a Roth 401 (k) If you do not have enough money to max out contributions to both accounts, experts recommend massaging out the Roth 401 (k) first to receive the benefit of a full employer. .

How much can I contribute to a Roth IRA if I have a 401k?

You can contribute a maximum of $ 19,500 in 2021 ($ 20,500 by 2022) to a Roth 401 (k) – the same amount as a traditional 401 (k). 9 If you are 50 or older, you can contribute an extra $ 6,500 as a catch-up contribution. 10 These limits are per individual; you don’t have to consider whether you’re married or single.

Does money grow in a Roth IRA?

A Roth IRA provides tax-free growth and tax-free retirement in retirement. Roth IRAs grow through composition, even during years when you can’t make a contribution. There is no RMD, so you can leave your money alone to continue growing if you don’t need it.

How Big is a Roth IRA? Generally, Roth IRAs see average annual returns of 7-10%. For example, if you are under 50 and have just opened a Roth IRA, $ 6,000 in annual contributions for 10 years with a 7% interest rate would be $ 83,095. Wait another 30 years and the account will grow to over $ 500,000.

Is a Roth IRA a good investment?

The Bottom Line If you’re earning money and meeting income limits, a Roth IRA can be an excellent tool for retirement savings. But keep in mind that this is only one part of an overall retirement strategy. If possible, it is a good idea to contribute to other retirement accounts as well.

Is a Roth IRA a risky investment?

Customers should know that, unlike a traditional IRA that provides a certain immediate benefit, the benefit of a Roth IRA could be zero. The biggest risk of a Roth IRA, however, is that the present value of the prepaid tax could be greater than the present value of the future tax savings.

Why a Roth IRA is a bad idea?

The Roth IRA may seem ideal, but it has disadvantages, including a lack of an immediate tax exemption and a low maximum contribution.

What does Dave Ramsey say about Roth IRA?

Like Roth 401 (k) s, Roth IRAs allow for tax-free growth and retirements (though, as with Roth 401 (k) s, you don’t save taxes on the year of your contribution). Ramsey enjoys these tax-free features, and recommends automating contributions to your Roth if your brokerage firm allows it (for the most part).

Why is a Roth IRA a bad idea? The Roth IRA may seem ideal, but it has disadvantages, including a lack of an immediate tax exemption and a low maximum contribution.

Why does Dave Ramsey recommend a Roth IRA?

When you’ve invested enough to earn your employer’s share, Ramsey suggests investing the rest of your money in a Roth IRA. … Like Roth 401 (k) s, Roth IRAs allow for tax-free growth and retirees (though, as with Roth 401 (k) s, you don’t save taxes in the year of your contribution ).

How does a Roth IRA work Dave Ramsey?

A Roth IRA is a retirement savings account that allows you to pay taxes on the money you put in front of you. Growth in your Roth IRA and any withdrawals you make after the age of 59 1/2 are tax-free, as long as you have had the account for more than five years.

How Roth IRA works Dave Ramsey?

How does a Roth IRA work? A Roth IRA is a retirement savings account that allows you to pay taxes on the money you put in front of you. Growth in your Roth IRA and any withdrawals you make after the age of 59 1/2 are tax-free, as long as you have had the account for more than five years.

Comments are closed.