How much should a 40 year old have in 401k?

What should my net worth be 40 Canada?

Contents

What is the net worth to be considered part of the 1% of 40-year-olds who consider themselves the richest in Canada? The Kickass Entrepreneur has shared the top 1% of the net worth in the 40-44 age group in Canada at $ 2,434,417.20 and the median net worth for the same age group at $ 174,000.

How much does the average person have in savings when they retire?

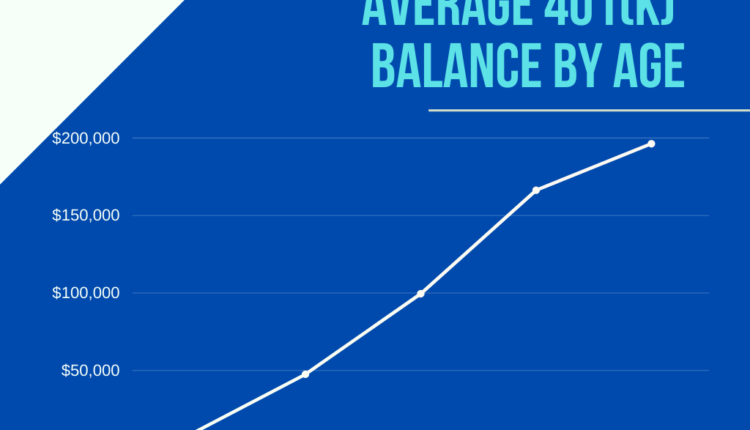

According to Fidelity, the following is what the average American has saved for retirement: 20-29: $ 15,000. 30 to 39: $ 50,800. 40 to 49: $ 120,800.

What is the average savings for retirement in 2020? According to Fidelity, in the first quarter of 2020, the average defined contribution plan balance was $ 126,083 and the average IRA balance was $ 135,700. Americans’ savings expectations for a comfortable retirement rose to $ 1.04 million in 2021, a 10 percent increase from 2020.

How much does the average 60 year old have in retirement savings?

If you are approaching age 60, you probably have retirement in mind. Have you saved enough? How much money does the average 60-year retirement savings have? According to data from the Federal Reserve, for people ages 55 to 64, that number is just over $ 408,000.

How much does the average 61 year old have saved for retirement?

Those who have retirement funds don’t have enough money in them: According to our research, people aged 56-61 have an average of $ 163,577, and those aged 65-74 have even less savings.

What is the average 401k balance for a 60 year old?

| AGE | YEARS WORKED | NO GROWTH |

|---|---|---|

| 30 | 8 | $ 144,500.00 |

| 35 | 13 | $ 242,000.00 |

| 40 | 18 | $ 339,500.00 |

| Four. Five | 23 | $ 437,000.00 |

What is the average net worth of a 60 year old?

The average net worth of a 60-year-old in the United States is approximately $ 200,000. However, for the above-average 60-year-old who is very focused on his finances, he has an average net worth close to $ 2,000,000.

How much does the average 65 year old have in retirement savings?

According to data from the Federal Reserve, the average amount of retirement savings for people between the ages of 65 and 74 is just over $ 426,000. While it’s an interesting fact, your specific retirement savings may be different than someone else’s.

What is the average 401K balance for a 65 year old?

| AGE | AVERAGE BALANCE OF 401K | AVERAGE BALANCE OF 401K |

|---|---|---|

| 55-64 | $ 197,322 | $ 69,097 |

| Sixty-five | $ 216,720 | $ 64,548 |

How much savings should I have at 65?

At age 65, you should have a savings / equity amount equal to 20X -25X your annual expenses. … In other words, if you spend $ 50,000 a year, you should have between $ 1,000,000 and $ 1,250,000 in savings or equity to live a comfortable retirement lifestyle.

What does the average 65 year old have saved for retirement?

According to data from the Federal Reserve, the average amount of retirement savings for people between the ages of 65 and 74 is just over $ 426,000. … The better question might be: how much savings do you need to feel comfortable in retirement?

How much savings should I have at 40?

At age 40, you should have saved a little over $ 175,000 if you are earning an average salary and follow the general guideline that you should have saved about three times your salary by then. … A good savings goal depends not only on your salary, but also on your expenses and the amount of debt you have.

How much should you start saving for retirement at age 40? To retire with $ 1 million in 25 years, a 40-year-old just starting out would need to invest $ 800 a month, a little less than 20% of the median income of $ 50,000.

How much wealth should you have at 40?

Net worth at age 40 At age 40, your goal is to have a net worth of twice your annual salary. So if your salary goes up to $ 80,000 in your 30s, then at age 40 you should be striving for a net worth of $ 160,000. Plus, it’s not just contributing to retirement that helps you build your net worth.

How much pension savings should I have at 40 UK?

Pension Calculator So if you start saving at 40, you should save 20% of your salary on a pension.

Can I retire at 55 with 300k UK?

Can I retire at 55 with £ 300k? On average, a retired person will spend £ 19,000 a year, while the average couple in retirement will spend £ 25,000 a year. This means that if you retire at 55 with £ 300k, one person will run out of funds in about 15 years and a couple in 12 years.

Can I retire at 60 with 500K UK?

Can I retire at 60 with 500K? Sure, £ 500K may seem like a decent amount of money, but it may not provide you with the lavish lifestyle you’ve been hoping for if you’re planning to retire at 60. If you retire at 60 with £ 500k in the UK, you could reasonably expect to take between £ 15-20K from your pension each year.

How much should a 40 year old have in their pension?

It is suggested that at the age of 40 you should realistically put 20% of your salary into your pension fund. This is a 5% increase over the suggested amount at thirty.

Comments are closed.