How much money does the average 40 year old have in the bank?

How much does the average 40 year old make?

Contents

- 1 How much does the average 40 year old make?

- 2 How can I build my wealth in my 40s?

- 3 How much should I have in my bank account at 40?

- 4 At what age should you be a 401k Millionaire?

For example, the average salary for an American at age 40 is $ 45,000, according to the chart. After that, the average salary only increases by $ 1,000 every five years, if at all. By age 65, a person who earned $ 45,000 at age 40 will earn $ 48,000.

What should my net worth be 40? Net worth at age 40 By age 40, your goal is to have a net worth twice your annual salary. So if your salary rises to $ 80,000 in your 30s, you should aim for a net worth of $ 160,000 by age 40. In addition, it doesn’t just help you contribute to retirement to create your net worth.

What should a married couples net worth be?

Depending on the source, the average net worth in America is somewhere between $ 150,000 – $ 250,000. But the average net worth in America is closer to $ 90,000.

Do you calculate net worth as a couple?

Do I have the same net worth as my spouse? Depending on how you and your spouse manage your household finances, your net worth may be the same or it may be drastically different. If both are listed as co-owners of their home, share a credit card or car, these funds will be credited to both.

How much money does the average married couple have?

Increasing the number of married couples According to the U.S. Census, the average household income run by a married couple aged 65 or over in 2019 was nearly $ 105,000. The median income of these households was nearly $ 75,000.

What percentage of 40 year olds are millionaires?

| Average net worth in the US | ||

| Age group | A millionaire? | 25% of the best |

| 20-30 years old | Maximum 1 percent | $ 36,393 |

| 30-40 years old | The best 2 percent | $ 190,450 |

| 40-50 years old | Top 9 percent | $ 344,507 |

At what age do most millionaires become millionaires?

Self-discipline (i.e., regular investing and living below your means) are key factors. The average age of millionaires is 57, which means most people need three or four decades of hard work to amass great wealth. The research was conducted by the authors, Thomas Stanley, Ph.D.

How rich should you be 40?

By age 40, your goal is to have twice the net value of your annual salary. So if your salary rises to $ 80,000 in your 30s, you should aim for a net worth of $ 160,000 by age 40. In addition, it doesn’t just help you contribute to retirement to create your net worth.

How much does the average 40 year old have saved?

According to this study, conducted by the Transamerica Center for Retirement Studies, the average retirement savings by age in the U.S.: Americans in their 20s: $ 16,000. Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000.

How much should a married couple have saved for retirement by age 40?

Retirement Savings Goals If you earn $ 50,000 by age 30, you should have $ 50,000 in a retirement bank. By age 40, you should have three times your annual salary.

How much should the average 40 year old have in savings?

You may start to think more seriously about your retirement goals. By age 40, you should save a little over $ 175,000 if you earn an average salary and follow the general guideline that you should save about three times your salary by then.

How can I build my wealth in my 40s?

7 tips on how to build wealth in your 40s

- Take advantage of your retirement plans. …

- Invest your money to accelerate wealth building in your 40s. …

- Create a debt repayment plan. …

- Reduce consumption. …

- Plan your estate. …

- Create multiple income streams. …

- Consider selling your house.

How much should I have in my bank account at 40?

Up to age 40: three times your income. Up to 50 years: six times your income. By age 60: eight times your income.

How much does the average person have in terms of age?

How much should a 25 year old have in his savings?

By age 25, you should save about 0.5 times your annual expenses. More than better. In other words, if you spend $ 50,000 a year, you should have about $ 25,000 in savings. 25 years is the age when you should get a job in an industry you like.

How much does the average 25 year old have saved UK?

The younger generations have the least money saved. Thus, those aged 25 to 34 put on average £ 3,544 aside, while adults in the UK have an average of £ 5,995 and £ 11,013 in the 35-44 and 45-54 age groups respectively.

What’s the average savings for a 25 year old?

By age 25, you should have saved about $ 20,000. Looking at data from the Bureau of Labor Statistics (BLS) for the first quarter of 2021, the average wages for full-time workers were as follows: $ 628 per week or $ 32,656 each year for workers aged 20 to 24.

How much does the average American have in savings 2021?

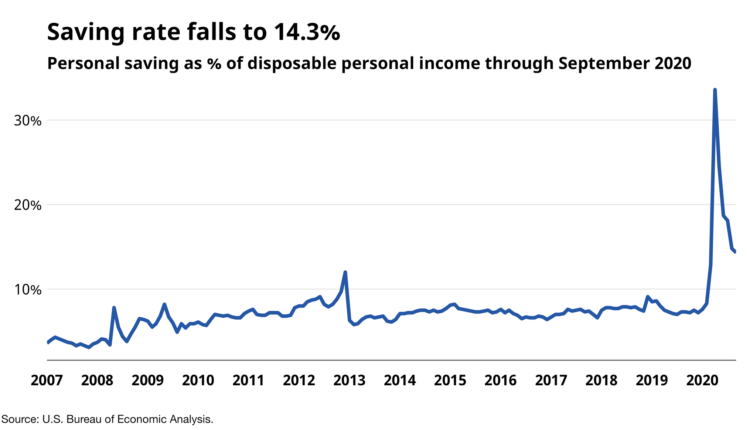

Overall, the survey found that average Americans ’personal savings rose 10% year-over-year, from $ 65,900 in 2020 to $ 73,100 in 2021. Retirement savings jumped 13% from $ 87,500 to $ 98,800.

How much money does the average person make in France?

Average annual wages in France 2000-2019 While average annual wages in 2008 were € 33,974, in 2019 they reached € 39,099. In 2019, most French citizens earned between € 1,000 and € 2,999 per month.

How much do you need to live in Strasbourg?

Summary of living costs in Strasbourg, France: The estimated monthly cost of a family of four is $ 3,458 (€ 3,022) without rent. Estimated monthly cost for one person is $ 996 (€ 871) without rent.

What does the average 40 year old have in savings?

Although the recommended amount of savings in a retirement plan is up to four times your annual salary, this is not a reality for many Americans. The average income for those over the age of 40 is just over $ 50,000, but the average amount of retirement savings for this age group is $ 63,000.

How much does the average 40 year old have in savings?

According to this study, conducted by the Transamerica Center for Retirement Studies, the average retirement savings by age in the U.S.: Americans in their 20s: $ 16,000. Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000.

How much money should a 40 year old have in the bank?

Up to the age of 40: Save three times your annual salary. If you earn $ 50,000, you should plan to save $ 150,000 for retirement by age 40.

At what age should you be a 401k Millionaire?

Recommended Amounts of 401,000 by Age Middle-aged savers (35-50) could become 401,000 millionaires around the age of 50 if they took advantage of their 401,000 and invested properly from the age of 23.

At what age should I be a millionaire? A typical “401 (k) millionaire” reaches a milestone after the age of 50, according to a Fidelity Investments report cited by the New York Times. On average, women reached the milestone at age 58.5, while the average man became a millionaire at age 59.3.

Are you a millionaire if you have a million in 401 K?

Fidelity Investments reports that the number of 401 (k) millionaires – investors with 401 (k) account balances of $ 1 million or more – reached 233,000 at the end of the fourth quarter of 2019, up 16% from the third quarter. 200,000 and more than 1000% of the 21,000 in 2009.

What is considered a millionaire in the US?

What is a millionaire? A millionaire is someone who has a net worth of a million dollars. Net worth is what you have, minus what you owe.

At what age does someone become a millionaire?

The average age of millionaires is 57, which means most people need three or four decades of hard work to amass great wealth. The research was conducted by the authors, Thomas Stanley, Ph.D., and William D. Danko, Ph.D.

Can you become a millionaire with 401K?

If you consistently add money to your 401 (k) and invest it, you can become a millionaire. Benefits such as tax deferral and business matching can make work easier than other investment accounts.

How much should be in my 401k to be a millionaire?

1. Set a monthly investment goal based on your age. … If you start contributing 401 (k) contributions at age 20 and pay them consistently for 42 years, investing just over $ 230 a month would make you a millionaire on your target date (assuming an 8% average annual rate of return).

Can you have a million dollars in 401k?

Your 401 (k) can be one of the most powerful tools available to you when it comes to building your retirement nest. In fact, it’s entirely possible to achieve an account balance of $ 1 million or more just based on money in your 401 (k) or similar employer-sponsored plan.

Comments are closed.